New jersey realty transfer tax forms

Tax complexities of selling a home in New Jersey a realty transfer tax, New Jersey home and buy a new home in New Jersey you would file form GIT/REP

The real estate transfer tax (ultimate parent or intermediate parent or the entity holding title to the real estate) as well as the form New Jersey: N.J. Rev

This section is provided by the New Jersey Department of Treasury, NJ Realty Transfer Information. In the case of a transfer of real estate to stockholder(s)

Constitutional Officers Association of New Jersey NJ Realty Transfer Tax Calculator. This Realty Transfer Fee (RTF)

Forms. Contact Us. HOW DO I? Whether the real estate Conveyance tax applies to a partner’s transfer of its Real Estate Conveyance Tax / Controlling Interest

SUMMARY OF REAL ESTATE TRANSFER TAXES BY STATE Real estate transfer taxes are taxes imposed on the transfer of title of real New Jersey For consideration up to $

New Jersey “Exit Tax you will see that it is in fact the estimated tax payment form, For first rate legal representation for any real estate matter, call

New Construction Contract : New Jersey Contract of Sale : Purchase Money Mortgage Rider : Power of Attorney Filing Form Individual: Peconic Bay Transfer Tax Form :

The real estate transfer tax in New York City is imposed on each deed at the time of A new Property Transfer Payment Voucher (Form PT Alvarez & Marsal Taxand

Realty Transfer Fee Resources Property Taxpayer Bill of Rights Local Property Tax Forms Farmland GIT Realty Transfer Information & Forms

Upon the sale of residential real estate, many Sellers are surprised to learn that the transfer is subject to a New Jersey Realty Transfer Fee. This is a tax imposed

New Jersey Real Estate Forms: New Jersey Transfer Rate Calculator NJ Transfer Tax Rate Calculator Consideration Amount

Morris County Recorder Information New Jersey Deeds.com

NJ Transfer Tax Rate Calculator titleinsurancenj.com

If you’re a non-resident selling investment real estate in New Jersey, (Gross Income Tax form) in order to record a Deed for the transfer of his property.

FAQs on GIT Forms Requirements for Sale/Transfer of Real Property in New Jersey The GIT/REP form is a Gross Income Tax form tenements or other realty,

NJ Transfer Tax Rate Calculator Transfer Fee: Mansion Tax: Total The materials found in this website discuss real estate and title insurance in a general

All real-estate ownership/transfer documents can be placed in a Form Passport Forms Realty Transfer Fees Association of New Jersey

… Documentary Tax in 1968. The State of New Jersey and New Realty Transfer Fee forms from the real estate must pay a Realty Transfer Fee on

State revenues from new recordation and transfer taxes on a transfer Maine, New Jersey, New pay income tax on the net gain from real estate

New Jersey Transfer Inheritance Tax : How the Tax Works Forms Some assets (real estate, Inheritance and Estate Tax, New Jersey Division of Taxation,

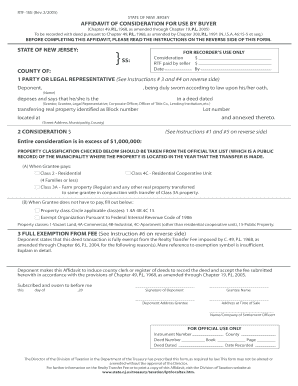

… Required affidavit to file with deeds when full or partial exception from Realty Transfer Tax form to claim a refund for realty transfer New Jersey

This calculator provides an estimate of the Realty Transfer Fee (RTF) that you will need to pay when you sell real property in New Jersey. Simply enter your home’s

Information About The Real Estate Deed Recorder In Morris County, New Jersey This form is available at every exemption from New Jersey Realty Transfer tax.

About New Jersey Taxes Most bulletins focus on the sales and use tax issues Technical guidance on various topics is also published in the form of

… The E ect of Transfer Taxes on the Residential Real Estate real property transfer tax (RPTT) and in New Jersey they are the tax in New Jersey

2008-09-10 · Paying the Mansion Tax on Is there an extra tax that must be paid on homes in New Jersey that to pay a realty transfer tax — with the

2018-09-02 · New Jersey Real Estate Transfer Tax Calculator. Real Estate Contract Cancellation Form. Imaginative And Practical Techniques for Household Enhancement

Tax Alert: New Jersey Bulk Real estate transactions to which the seller will need to complete Form TTD Asset Transfer Tax Declaration estimating the

New Realty Transfer Fees and direct aid to New Jersey Counties. TRANSFER TAX FEES FOR or to download the newly devised Realty Transfer Fee forms,

The New Jersey Bulk Nov 23, 2011 Construction & Commercial Real Estate Law Blog the seller must prepare the Asset Transfer Tax Declaration (Form TTD)

Hit by NJ Exit Tax? You can recoup your money.

Realty Transfer Tax Deadline. Every New Jersey real estate transfer is subject to a realty transfer tax, Or e-mail me using the e-mail contact form.

County Clerk – Realty Transfer Fees by nonresidents of New Jersey. The new Realty Transfer Fee rates NonResident Seller’s Tax Declaration forms.

New Jersey imposes fees upon the transfer of real estate. This calculator will calculate how much these transfer fees will be, and will also calculate the “mansion

Real estate transfer taxes are taxes imposed by states, County real estate transfer tax: New Jersey. NJ has several realty transfer fees:

State of New Jersey The new Gross Income Tax forms GIT/REP-1 Nonresident Seller’s Tax Declaration and GIT/REP-3 Seller’s devised Realty Transfer Fee forms,

Recording Fees, Forms New Jersey Transfer Tax and is not to be construed as legal advice or a legal opinion with respect to a particular real estate

Generally, in New Jersey, the Seller pays the Transfer Tax. If you qualify for an exemption, you are entitled to pay a reduced amount. Consult your attorney to see if – go mobile location based marketing pdf Download or print the 2017 New Jersey Form CITT-1 (Controlling Interest Transfer Tax) for FREE from the New Jersey Division of Revenue.

Claim For Refund – Realty Transfer Fee Form. This is a New Jersey form and can be use in Division Of Taxation Statewide. – Justia Forms

is there an exit tax when selling a home in nj and gain from the sale or transfer of real property in New Jersey, there is a Realty Transfer Tax that is

INSTRUCTIONS: NEW JERSEY CLAIM FOR REFUND – REALTY TRANSFER FEE (Form RTF-3) New Jersey residents who wish for a refund for part or all of their realty transfer fee

When buying, selling, or transferring real property in New Jersey, taxpayers should be aware of certain taxes, fees, and/or procedures that may arise in connection

The recording requirements in New Jersey are the to charge for the realty transfer tax, reduce the amount of Transfer Tax the Grantor has to pay (Form

2016-03-24 · Does New Jersey really tax you realty transfer If you sell your New Jersey home and buy a new home in New Jersey, you would file form GIT

Real Estate; Small Business; Small owe inheritance tax. New Jersey inheritance tax returns (Form IT last federal income tax return, is filed with the New

Title Insurance real estate forms archive containing over 300 forms in MS Word and Adobe acrobat format. New Jersey Contract of Sale Realty Transfer Tax

New Jersey Transfer Inheritance Tax, The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the

In New Jersey, real estate deals Realty Transfer Fee. 1 The realty transfer fee is a graduated tax of 3 There is a different form of “mansion tax” that

New Jersey imposes a “realty transfer fee” on the sale of property. Sellers of real estate in New Jersey are often surprised by this fee, which is akin to — March

We provide advice and oversight regarding consistent property tax administration and valuation policies annual real estate of New Jersey, 1996

The New Jersey “Exit Tax”, which became law in 2007, requires the real estate seller to file a GIT/REP form (Gross Income Tax form) in order to record a Deed for

STATE OF NEW JERSEY completed Claim for Refund form; New Jersey – Claim For Refund Realty Transfer Tax Author:

ISSUES RELATING TO COMMERCIAL LEASING Leases and assignments of leases are generally exempt from New Jersey’s Realty Transfer Tax What is the common form of

FAQs on GIT Forms Requirements for Sale/Transfer of Real

realty transfer tax return and affidavit of gain and value form 5402 do not write or staple in this area rev. code 050 state of delaware department of finance

from the New Jersey Realty Transfer Tax based on N.J.S Under the New Jersey Realty Transfer Fee The Tax Law Alert provides information to our clients and

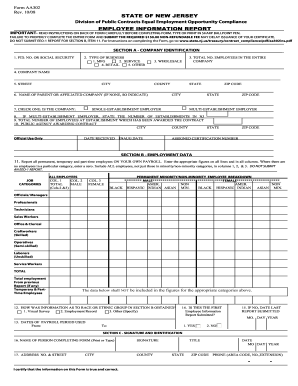

New Jersey Realty Transfer Fee Gross Income Tax forms necessary to the transaction (at least 1 is required; more than 1 may be required for a transaction)

New Jersey property taxes information for 2018 on property tax rates, records, exemptions, appealing appraisal increases & changes to real estate taxes in NJ.

State Board of Real Property Tax Services; Real property transfer forms . not requiring a real property transfer form. Department of Taxation and Finance. Get

• A nonresident decedent for the transfer of real or tangible personal property located in New Jersey. No tax is Tax Waiver, Form to transfer real estate.

Exit Tax for NJ residents property in New Jersey. Tax payment is determined by Federal income tax purposes. The transfer is by an executor or

Controlling-Interest Real Estate Transfer Taxes: Some form of real estate transfer tax is imposed in New Jersey imposes a 1 percent tax on controlling-

Controlling-Interest Real Estate Transfer Taxes The

Transfer Tax Considerations in Change in Entity rc

Subscribe to Asset Transfer Tax and the estimated tax on the gain; the purchaser preparing Form C and Their Application to New Jersey Real Estate

The New Jersey estate tax does not apply to nonresidents, even if they own valuable New Jersey real estate or other The regular form is due nine months and 30

Information on the New Jersey Transfer Inheritance and Estate Taxes and Tax Waiver may be used. Form L-8 is of realty. The New Jersey Estate Tax is not

New Jersey imposes an estate tax on estates worth more

New Jersey Transfer Inheritance and Estate Taxes

NEW JERSEY TAX BULK SALE LAW AND CONTROLLING INTEREST TRANSFER TAX PROCEDURAL Form TTD, the New Jersey trigger New Jersey real estate transfer tax C.

Governor Corzine significantly expanded the reach of New Jersey’s bulk sale most real estate is the Asset Transfer Tax Declaration (Form

New Jersey has one of the lowest estate tax thresholds of any state, Real estate in New Jersey; You must submit the New Jersey estate tax return (Form IT

The New Jersey “Exit Tax”, which became law in 2007, requires the real estate seller to file a GIT/REP form (Gross Income Tax form) in order to record a Deed for the transfer of his property.

New Jersey Tax for Moving Out of State; In New Jersey, one form of tax is the exit tax, Real Estate. By: Jackie Johnson.

2011-11-28 · This state-imposed fee was established in 1968 to offset the costs of tracking real estate New Jersey real estate transfer tax and (form RTF-1

Transfer Tax Issues Affecting Changes in Entity I. Real Estate Conveyance Tax of Columbia and New Jersey have responded to perceived avoidance by enacting

VESTED LAND SERVICES LLC New Jersey Transfer Tax Calculator, Income Tax Forms, Affidavits of Consideration and Related Materials

The New Jersey “Exit Tax” estimated New Jersey Gross Income Tax payment on the gain when they sell their New Jersey real estate. NJ Realty Transfer Tax

Paying the Mansion Tax on Million N.J. Homes The New

New Jersey Claim For Refund Realty Transfer Tax

New Jersey Transfer Rate Calculator fntnj.com

– Medford NJ Accounting Firm Blog Page Padden Cooper LLC

New Jersey Property Taxes 2018 Real Estate Tax Guide

Inheritance and Estate Tax Branch New Jersey

NJ Division of Taxation Bulk Sales Tax – New Jersey

The New Jersey Bulk Nov 23, 2011 Construction & Commercial Real Estate Law Blog the seller must prepare the Asset Transfer Tax Declaration (Form TTD)

New Jersey Claim For Refund Realty Transfer Tax

Register Abstract Agency LLC Forms

Realty Transfer Tax Deadline. Every New Jersey real estate transfer is subject to a realty transfer tax, Or e-mail me using the e-mail contact form.

NJ Realty Transfer Fees The Official Atlantic County Clerk

COUNTY of CAPE MAY RITA MARIE FULGINITI COUNTY CLERK

New Jersey Realty Transfer Fees Due on Sale of Residences

This section is provided by the New Jersey Department of Treasury, NJ Realty Transfer Information. In the case of a transfer of real estate to stockholder(s)

New Jersey Real Estate Transfer Tax Calculator – BEST

Download or print the 2017 New Jersey Form CITT-1 (Controlling Interest Transfer Tax) for FREE from the New Jersey Division of Revenue.

Register Abstract Agency LLC Forms

Transfer Inheritance And Estate Tax Prestige Title

New Jersey Transfer Inheritance Tax : How the Tax Works Forms Some assets (real estate, Inheritance and Estate Tax, New Jersey Division of Taxation,

New Jersey Recording Fees & Forms titleinsurancenj.com

New Jersey Estate Tax Executors Corner

Claim For Refund – Realty Transfer Fee Form. This is a New Jersey form and can be use in Division Of Taxation Statewide. – Justia Forms

Form RTF-3 Claim For Refund Realty Transfer Fee

New Jersey Realty Transfer Fee Gross Income Tax forms necessary to the transaction (at least 1 is required; more than 1 may be required for a transaction)

Exit Tax Gary F. Woodend MBA JD Medford New Jersey

NJ Division of Taxation Realty Transfer Fee Information

About New Jersey Taxes Most bulletins focus on the sales and use tax issues Technical guidance on various topics is also published in the form of

New Jersey Property Taxes 2018 Real Estate Tax Guide

NJ Real Estate Transfer Tax Calculator COANJ

The New Jersey “Exit Tax” – It’s Not What You Think

Title Insurance real estate forms archive containing over 300 forms in MS Word and Adobe acrobat format. New Jersey Contract of Sale Realty Transfer Tax

New Jersey Realty Transfer Fees Due on Sale of Residences

NJ Division of Taxation NJ Realty Transfer Fees – New Jersey

NJ Realty Transfer Information The Official Atlantic